Why Ballast

Why Ballast

Ballast’s Origins

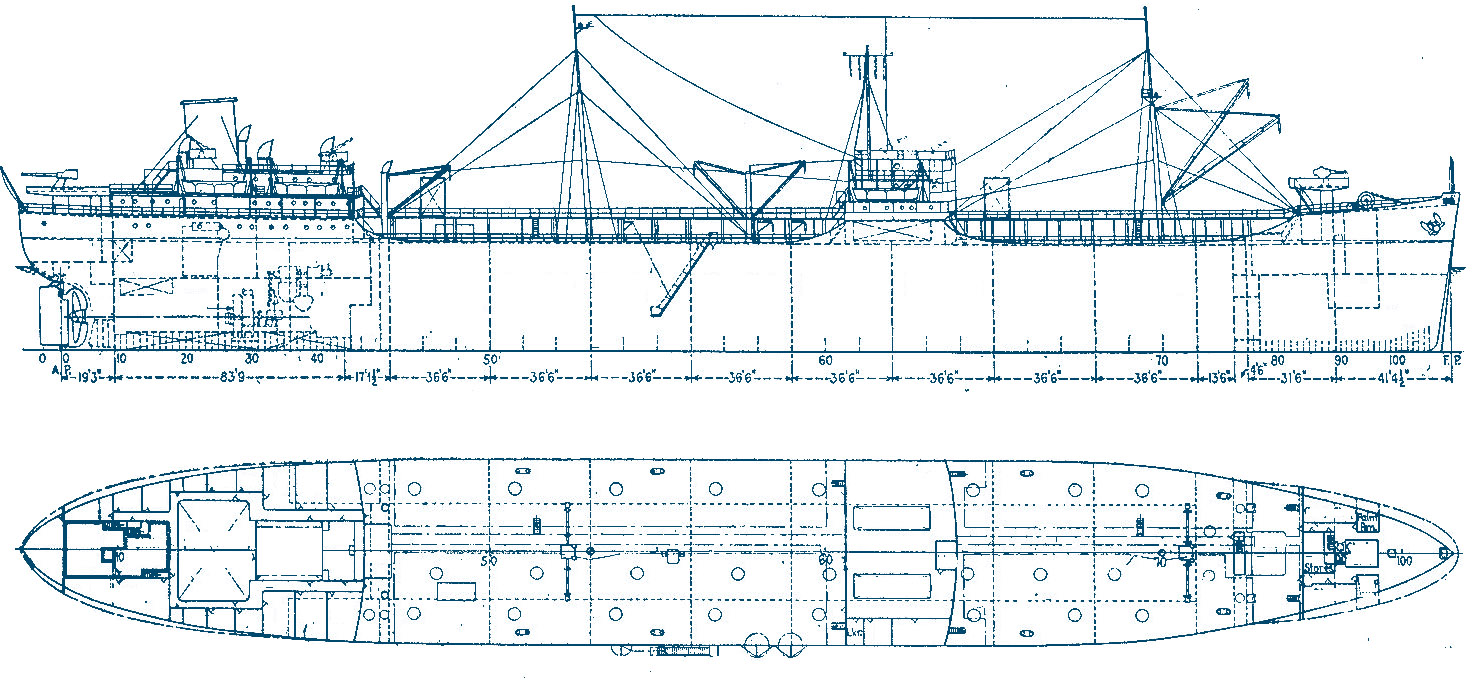

Why should anyone care about another small-cap value strategy? For us, it starts with why we launched Ballast. We weren’t satisfied with the status quo of value investing – too many managers were buying “cheap” stocks without regard for quality or downside. In 2015 we founded Ballast to preserve and protect a process we began building together in 2004—one rooted in downside-first analysis and a conviction that quality and discipline outperform over full cycles. The firm was created to ensure we could apply our strategy with complete independence, long-term alignment, and zero compromise. The name “Ballast” symbolizes steadiness in rough seas – a strategy built to cut through choppy markets and keep portfolios afloat when others sink.

The Crew at the Helm

Each member of Ballast’s investment team brings decades of experience – and something rarer: a shared mindset shaped by credit discipline and a deep respect for downside risk. Ragen Stienke, Jay Singhania, and Tom Fogarty came up through the ranks as fundamental analysts, with formative years in credit research and institutional equity strategy. That background shaped their DNA: they analyze stocks like lenders – asking what could go wrong before reaching for return.

They’ve spent their careers navigating crises and recoveries – from the dot-com bust to the global financial crisis to COVID – sharpening a protector’s mentality that still drives every decision. What motivates them is simple but powerful: do right by clients. That begins with downside-first analysis and extends to a culture where titles don’t matter – any analyst can challenge any assumption, and healthy debate is part of daily life.

This internal chemistry is Ballast’s hidden edge. There’s no friction – just flow. Decisions are fast, ideas are tested, and the team remains focused on one goal: compound capital while protecting it. The result? A tight-knit team executing a consistent, repeatable process without style drift. That clarity – and the fact that they’ve personally invested alongside clients – creates a culture of accountability, alignment, and humility.

At Ballast, it’s not just about beating benchmarks – it’s about earning trust, year after year.

Ballast’s Edge in Small Cap

Ballast’s strategy breaks the mold of traditional small-cap value in several key ways. First, we prioritize quality over plain cheapness – you won’t find “cigar butt” stocks in our portfolio. Every company we own has solid profits or cash flow today, not just a low price tag. We actively avoid heavily indebted, broken businesses even if their multiples look enticing. Second, we invert the usual process: most managers hunt for upside and then consider risks; we do the opposite. Our team hunts for reasons not to invest – we rigorously test how much we could lose on a stock before we ever examine the upside. If the downside isn’t acceptable, we pass. Third, we aren’t benchmark constrained. We run a true high-conviction portfolio and let our stock selection drive sector exposure (for example, we’ve been deeply underweight in Financials and REITs when we felt those sectors lacked quality). We’ll gladly hold cash or deviate from index weights to protect clients’ capital. Finally, risk management is woven into everything we do. We utilize a real-time risk model to continuously monitor our factor and industry exposures. This ensures that our outperformance comes with lower volatility – historically our strategy captured considerably less downside than the index, while still outperforming over a full cycle. In short, Ballast’s difference boils down to discipline: We’d rather be consistently good than occasionally great but frequently terrible. That discipline in process leads to a differentiated return profile that stands out in the small-cap arena.

Discipline Over Drama: How We Think About Downside

We don’t claim to sidestep every sharp correction – particularly in today’s market, where volatility can spike faster than fundamentals can respond. Our approach to downside is different: We focus on preserving capital across full cycles by aiming to build a portfolio made up of high-quality, cash-generative businesses that can self-fund growth and compound through disruption.

During extreme drawdowns – like Q1 2020 or Q1 2025 – our holdings may trade down with the broader market, but our discipline shows up in how we respond, not in short-term immunity. Those moments allow us to upgrade the portfolio into better businesses at better prices, which has historically driven strong rebound performance and long-term alpha.

In short, our downside protection isn’t about quarter-to-quarter insulation. Our goal is to position clients to win the long game, without betting on market timing.

Built for the Full Cycle: Outperformance that Endures, Volatility that Doesn’t

Ballast offers a rare combination: the return potential of small-cap equities with the downside profile of a defensive strategy. We provide ~2%–3% net annualized alpha since inception with materially lower drawdowns than the Russell 2000 Value, making us a steady hand in the small-cap sleeve of a multi-asset portfolio.

Institutional clients choose Ballast because of the strategic role we play – as a diversifier for large-cap or growth-heavy portfolios, and as a problem solver for allocation gaps. Small-cap value has historically rotated back into leadership after long lulls, and we’re positioned to capture that turn with a risk-first process that delivers top-tier returns* with less volatility than that of the benchmark.

Ballast also offers a liquid, transparent alternative to private equity. Like PE, we invest in inefficient small-cap companies with long growth runways. Unlike PE, we offer daily liquidity, no lockups, and clear mark-to-market pricing – making us a compelling complement or substitute for illiquid private allocations.

Finally, we actively avoid the speculative tail of the index. Over 30% of the Russell 2000 Value is made up of “zombie” companies that can’t cover their interest costs. Ballast owns real businesses with real cash flows, focused on compounding value and protecting capital.

The result? Long-term partners (or clients) have benefitted from hard to find alpha with a safety net.

Numbers Change, Principles Don’t

This unofficial motto captures the essence of Ballast’s culture. We’ve designed our firm to endure by adhering to timeless values. One is an absolute commitment to risk management and prudence – we will never stretch for a short-term gain that violates our margin-of-safety mantra. Another is putting clients first – we view ourselves as stewards of our investors’ capital, and we back that up by investing alongside them (our team’s wealth rises and falls with the strategy’s performance). We also place huge importance on intellectual honesty. Our team members are expected to speak up and poke holes in each other’s ideas – no “yes-men” here. This openness ensures we consider diverse viewpoints and don’t fall prey to groupthink. Lastly, we value patience and consistency: We do not panic in downturns or chase hype in euphoric markets. We’d rather be consistently good than occasionally great but erratic. These values guide how we hire, how we invest, and how we partner with clients. They are the North Star for every decision at Ballast, ensuring we remain true to our mission no matter what the market throws at us.

*9th percentile versus the Ballast U.S. Small Cap Value peer group over the last 7 years ending 12/31/24 according to eVestment.